Building Employee Development Plans: A Strategic Guide Powered by Employee Monitoring Software | Controlio Insights

In the competitive talent landscape of late 2025, where 75% of employees expect personalized growth opportunities to stay engaged (Gallup’s State of the Global Workplace 2025), crafting robust employee development plans is essential for retention and performance. Controlio, a leading employee monitoring software and time-tracking SaaS, supports this by providing detailed work hours analytics to identify skill gaps and track progress in real time, ensuring plans evolve with individual needs. Its value proposition? AI automation that integrates seamlessly with cloud-based solutions, offering data insights to boost employee productivity and remote workforce management, all while prioritizing SaaS security and compliance tracking for confidential growth data. As organizations seek scalable ways to visualize and share these plans, resources like templates from Venngage pair perfectly with employee monitoring software, transforming static documents into dynamic tools that drive project performance and team efficiency.

I’ve seen the power of well-designed development plans firsthand while … READ MORE >>>

The Crucial Distinction: Unpacking ‘Car Life Insurance’ and Protecting Your Family

For many, a new car brings excitement, freedom, and – often – a significant loan. As you sign the paperwork, you might encounter an offer for something vaguely termed “car life insurance.” This phrase, while seemingly reassuring, can be deeply misleading. What exactly are you being offered, and more importantly, what type of insurance truly protects your family’s financial well-being if you were no longer there to make those car payments? Let’s unpack the crucial distinction between credit life insurance for your car loan and comprehensive personal life insurance.

Deep Dive: Credit Life Insurance for Your Car Loan

When a lender offers “car life insurance,” they are almost certainly referring to credit life insurance. This is a specific type of policy designed to protect the lender, not your family directly. Here’s how it works: if the borrower (the person who took out the car loan) passes away, the … READ MORE >>>

Mastering Auto Financing: Your Guide to the Best Car Loan

The excitement of buying a car can quickly turn into anxiety in the finance office. For most people, auto financing is one of the most expensive and least understood transactions they will ever make. The biggest mistake buyers make is relying solely on the dealer to arrange financing. This cedes control of the negotiation, often resulting in higher rates and thousands of dollars in unnecessary interest over the life of the loan. Successful auto financing is a battle won before you start shopping for the car, by establishing direct lending through pre-approval.

Know Your Financial Scorecard

Before you even browse listings, you must understand the financial metrics that determine your borrowing cost. The lender uses three critical factors to set your rate:

- Credit Score: Your FICO score is paramount. Buyers with scores above 740 typically qualify for the lowest promotional rates. If your score is below 680, dedicating time to

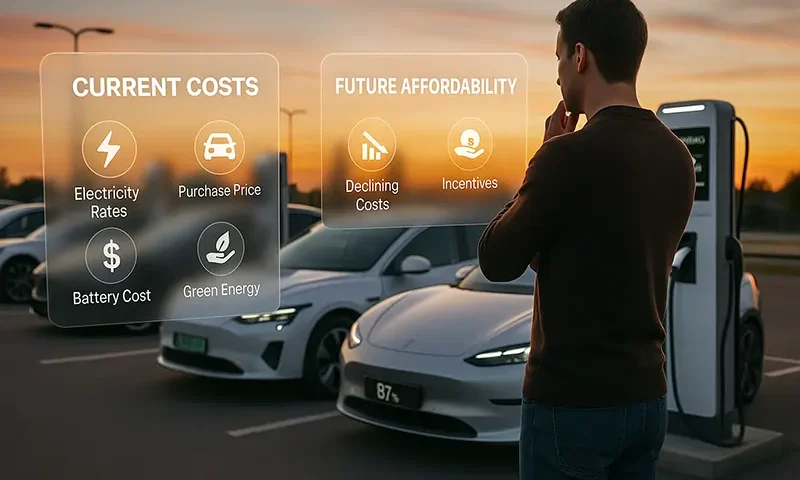

The Crossroads of EV Adoption: Market Reality and the Future of Affordability

The shift toward electric vehicles (EVs) is a story of explosive growth, followed by a recent market stabilization that some prematurely call a “slowdown.” While global sales continue to climb, the industry is currently stalled at a crucial juncture: EVs are still largely a luxury for early adopters, and they must become a mass-market reality. The inevitable transition to an electrified future hinges on solving the “three A’s”: Affordability, Accessibility (Charging), and Awareness.

The thesis is clear: the EV industry must accelerate its work on the fundamentals to move beyond its current luxury segment and into the heart of the consumer market.

Barrier 1: The Cost of Entry

The primary roadblock to mass adoption remains the high sticker price. An EV still costs significantly more upfront than an equivalent gasoline-powered car, and the villain of this story is the battery. The lithium-ion battery pack represents the … READ MORE >>>

Driving the Volatility: The Boom, the Bust, and the Economic Forces Reshaping the Used Car Business

The used car market is the largest, most active segment of the global auto industry, yet for decades it remained predictable, defined by consistent depreciation. That changed dramatically over the last few years. At one point, used car values were appreciating faster than many assets, leaving both dealers and consumers reeling. This period of unprecedented volatility was the result of a perfect storm of supply shortages and unusual consumer demand, and its ripple effects are still profoundly reshaping how the car business operates for dealers, lenders, and everyday drivers.

The Anatomy of the Boom (2020–2022)

The seismic shift in the used car market began with a cascade of failures in the new car supply chain. The primary catalyst was the semiconductor shortage. Modern vehicles require dozens of advanced computer chips, and when global chip production slowed or halted during the pandemic, major manufacturers were forced to drastically cut production. … READ MORE >>>